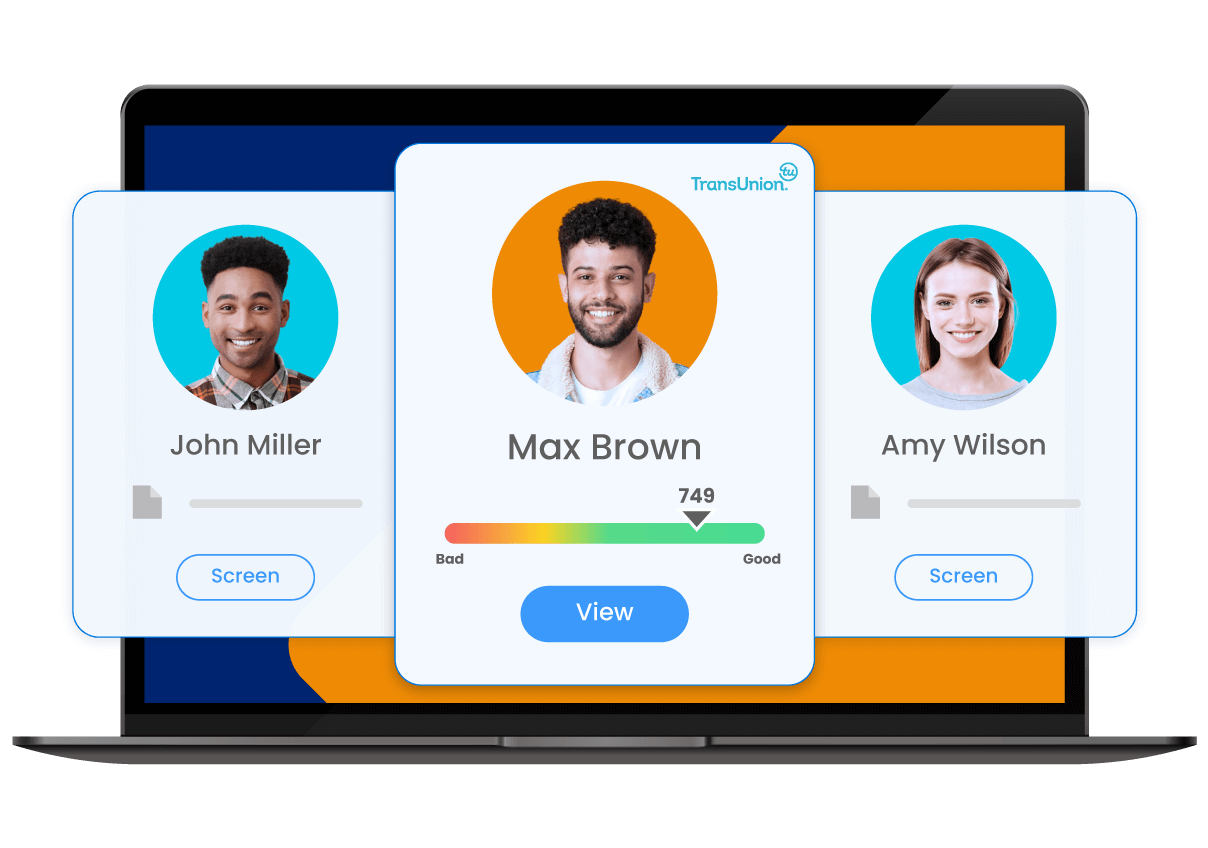

ScoreCard Pro

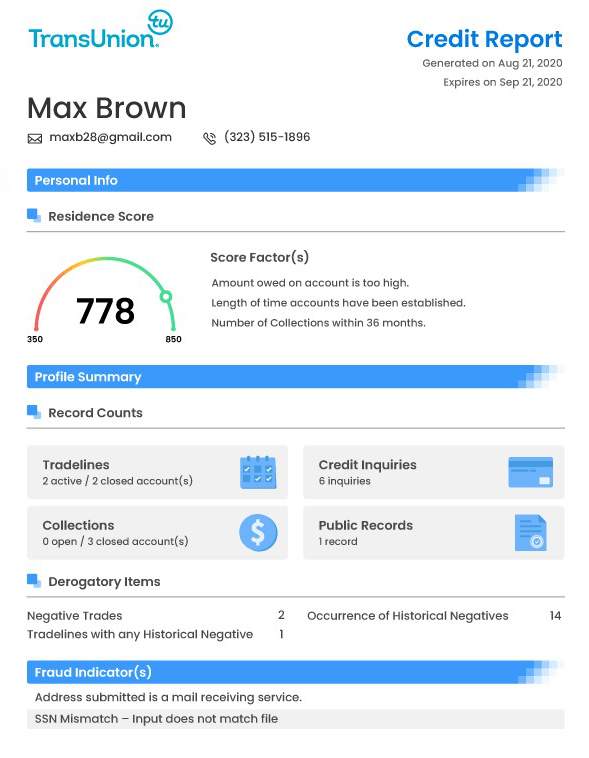

Like a Credit Score, ScoreCard Pro provides a tenant risk score (0-100) and generates a rental recommendation based off your applicant acceptance criteria. Promote Fair Housing Laws by providing a consistent applicant selection process. Each individual score is based on data from multiple sources:

- Credit History

- Credit Score

- Delinquent Accounts

- Collections/Charge-offs

- Mortgage Accounts

- Rental Collections

- Utility Collections

- Bankruptcy Records

- Tax Liens

- Judgment Records

- Eviction History

- Criminal History

- Income Ratio Criteria

- Resident Verification Criteria

- Employment Verification Criteria

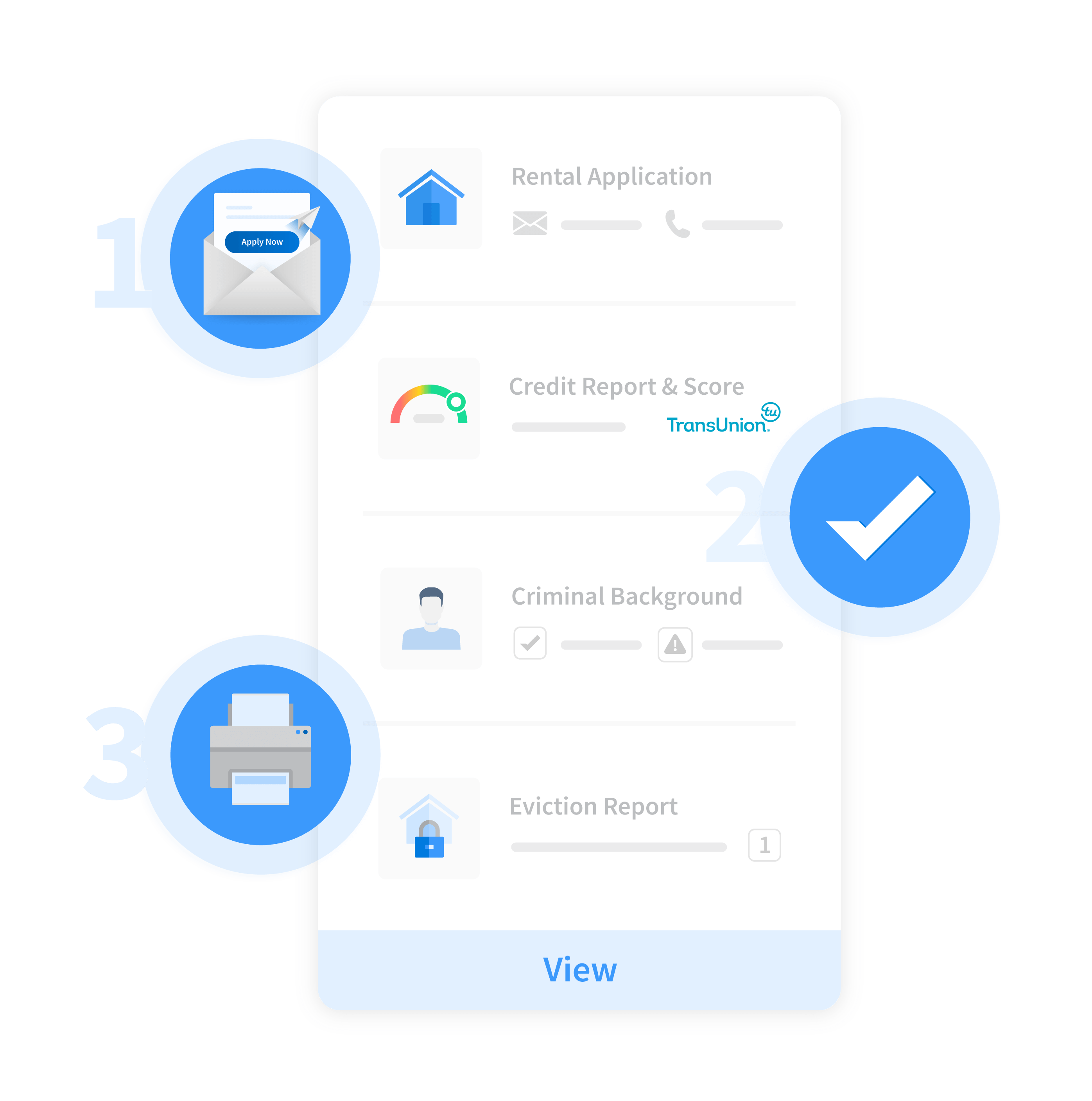

Rental Application

- Branded with your Company Logo

- Embedded Online Application, your applicant never leaves your website!

- Customable Application forms, setup to your unique needs

- Applicant Tracking

- Automated Notifications

- Customizable Payment Options

Tenant Screening

Rent with confidence with our FCRA compliant screening procedures

- QA Review, Quality Assurance procedures include an Insight staff review of report results

- QuickVerify

Fraud Prevention

As more and more property operators move to online lease applications and digital channels, it is imperative to verify the identity of both online and in-person applicants.

- CIV

- IRS

- Applicants Bank

- Income Verification

Disclosure Delivery

- Email or Text Message disclosures to your applicants

- Adverse Action Letter (i.e., Denial Letter)

- Conditional Acceptance Letter

- Acceptance Letter

- Consumer Reports

- VAWA (Violence Against Women’s Act)

- Any disclosure you need!

- Disclosure Queue allows you to manage disclosures that have been delivered.

Online Leasing

Say goodbye to endless paperwork and data entry while arranging in-person lease signings. Automate, streamline and organize leasing documents. Your leasing staff will save considerable time on data entry while reducing errors associated with manual entry.